Form 1040 Schedule B 2024 – – To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D exchanges required to send 1099-B forms starting in tax year 2023. Until then, if you .

Form 1040 Schedule B 2024 –

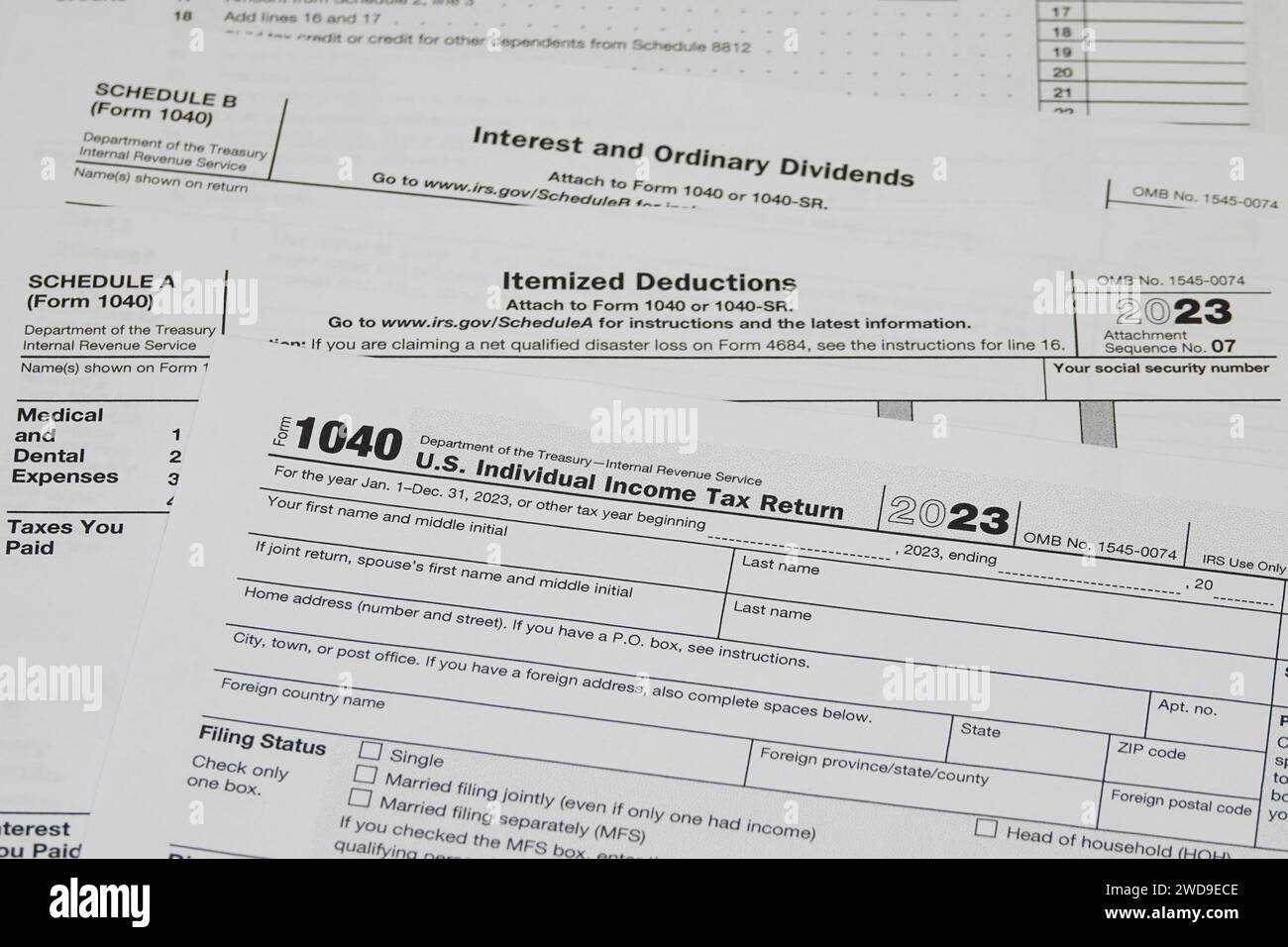

Source : www.dochub.comItemized deductions hi res stock photography and images Alamy

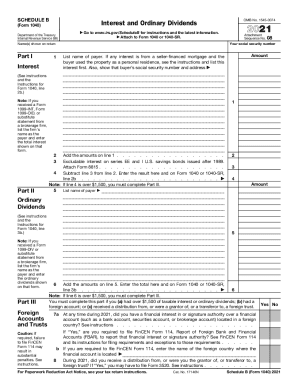

Source : www.alamy.com2017 2024 Form IRS 941 Schedule B Fill Online, Printable

Source : form-941-schedule-b.pdffiller.comForm 1040 For IRS 2024 | How To Fill Out Schedule A B C D

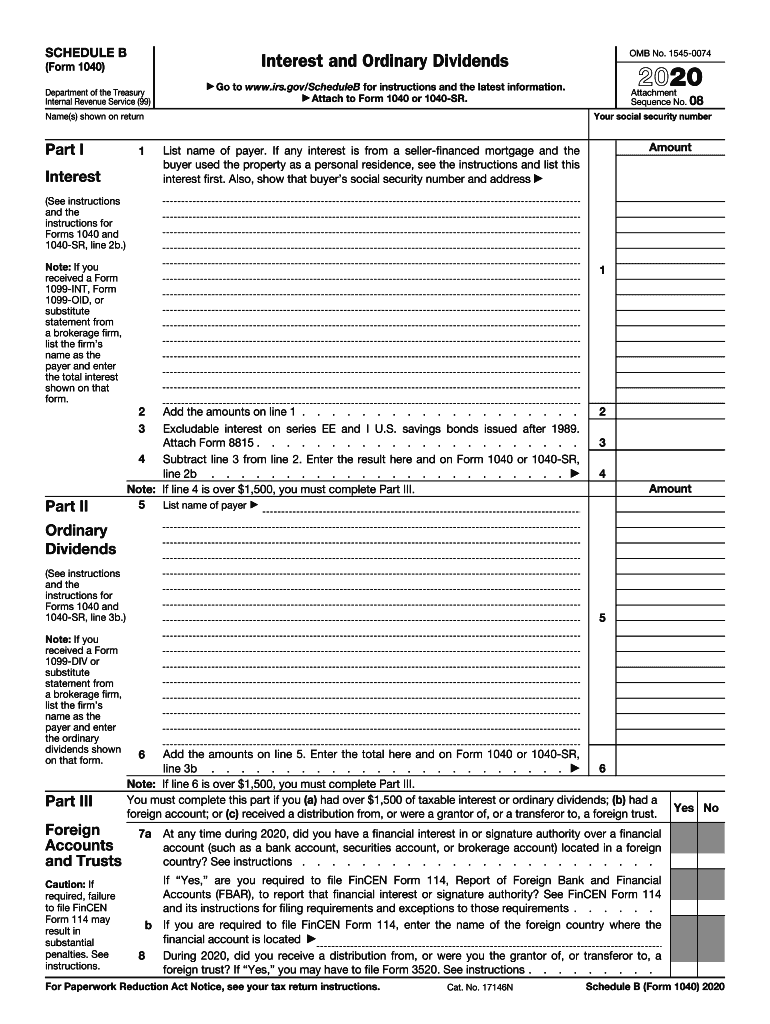

Source : nsfaslogin.co.zaIRS Schedule B (1040 form) | pdfFiller

Source : www.pdffiller.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgForm 1040: U.S. Individual Tax Return Definition, Types, and Use

Source : www.investopedia.comSchedule b: Fill out & sign online | DocHub

Source : www.dochub.comIrs Schedule B for 2018 2024 Form Fill Out and Sign Printable

Source : www.signnow.comForm 1040: U.S. Individual Tax Return Definition, Types, and Use

Source : www.investopedia.comForm 1040 Schedule B 2024 – Schedule b: Fill out & sign online | DocHub: If you are a sole proprietor, you report your business profit or loss on Internal Revenue Service Schedule C of Form 1040, Profit or Loss of the loss on Section B of Form 4684. . Your 1040 will come with a number of schedules – like Schedule 1 and Schedule he says you might receive a 1099-K form if you engage in high-volume trading; a 1099-B if you show gains or .

]]>

:max_bytes(150000):strip_icc()/1040.asp-final-8113a173a9ce4bf699ffe7e1a5b47156.png)

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)